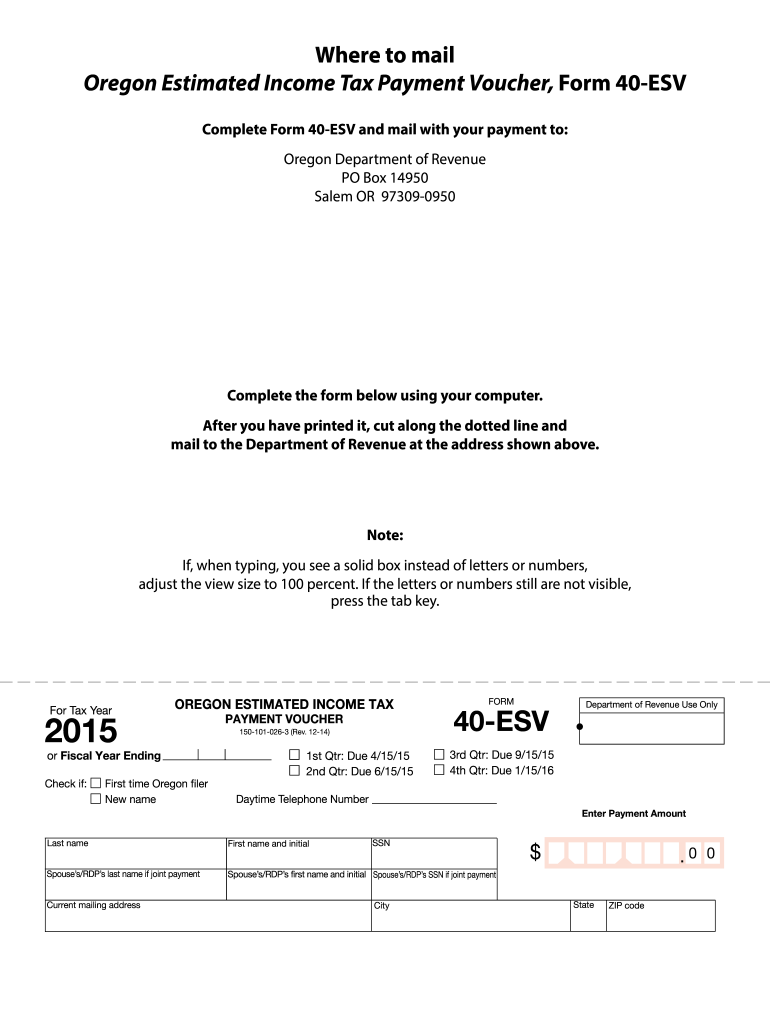

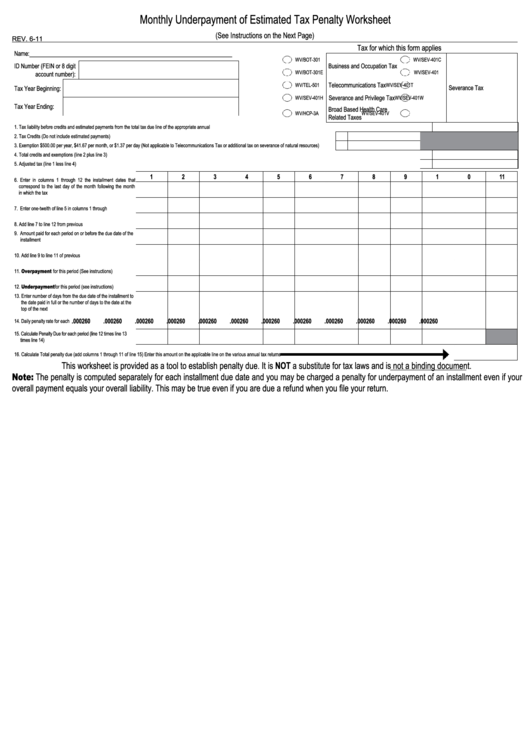

2025 Estimated Tax Worksheet Instructions - Monthly Underpayment Of Estimated Tax Penalty Worksheet Template, Estimated taxes are due quarterly, usually on the 15th day of april, june, september and january of the following year. The estimated excise payment worksheet provides a means to calculate any current excise due under mgl ch 63. 20252025 Form IRS Instruction 1040 Line 20a & 20b Fill Online, Pay a bill or notice (notice required) sales and use tax file and pay. Generally, a fiduciary of an estate or trust must pay estimated tax if the estate or trust is expected to owe at least $1,000 in tax for 2025 and can expect its withholding.

Monthly Underpayment Of Estimated Tax Penalty Worksheet Template, Estimated taxes are due quarterly, usually on the 15th day of april, june, september and january of the following year. The estimated excise payment worksheet provides a means to calculate any current excise due under mgl ch 63.

Annualized Estimated Tax Worksheet Worksheet Template Tips And Reviews, Explanations of your deductions, exemptions and credits appear in the tax form instructions. The total of your credits, including estimated tax payments, is less than 90% of this year’s tax due or 100% of last year’s tax due (110% of last year’s tax if your federal adjusted.

If first voucher is due on april 15, 2025, june 15, 2025,.

Pa Estimated Tax Form Fill Online, Printable, Fillable, Blank pdfFiller, Instructions for form 2210 (2023) underpayment of estimated tax by individuals, estates, and trusts. To calculate your estimated tax for 2025, estimate your adjusted gross income, taxable income, taxes, deductions, and credits for the year.

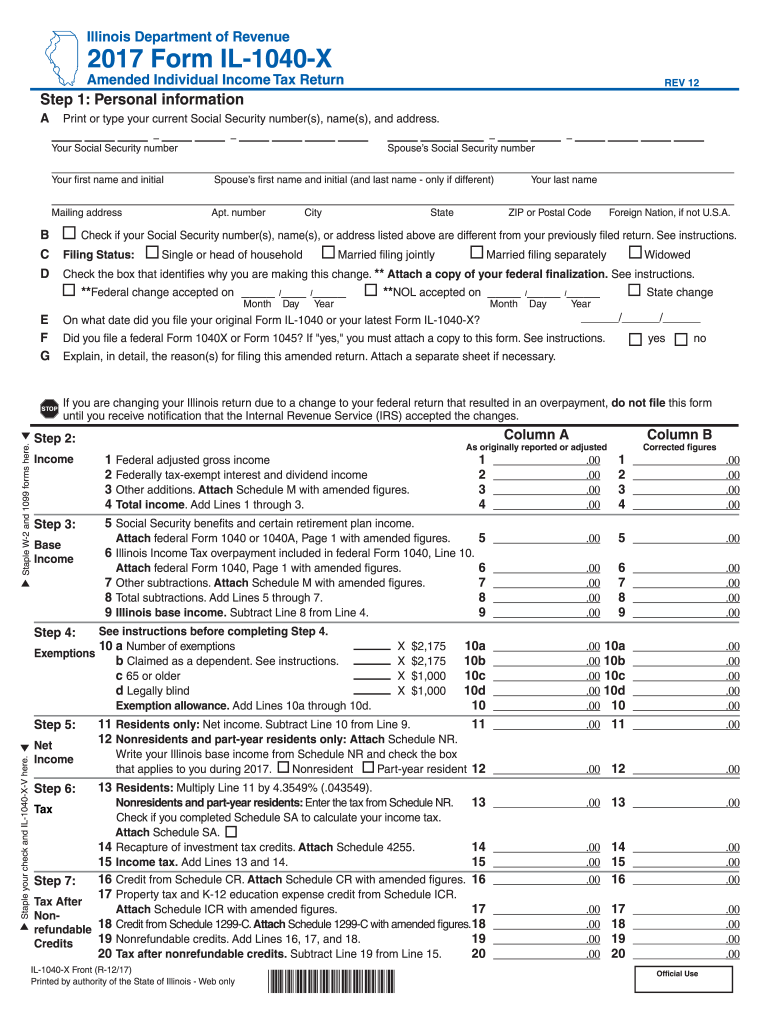

Illinois 1040 20252025 Form Fill Out and Sign Printable PDF Template, Failure to comply with the. One notable exception is if the 15th falls.

Printable tax form 1040 printable form 2025, additionally, if you submit your 2023 federal income tax return by jan.

Section references are to the internal revenue code unless otherwise. Failure to comply with the.

2025 Estimated Tax Worksheet Instructions. Who must make estimated payments? Estimated taxes are payments made to the irs throughout the year on taxable income that is not subject to federal withholding.

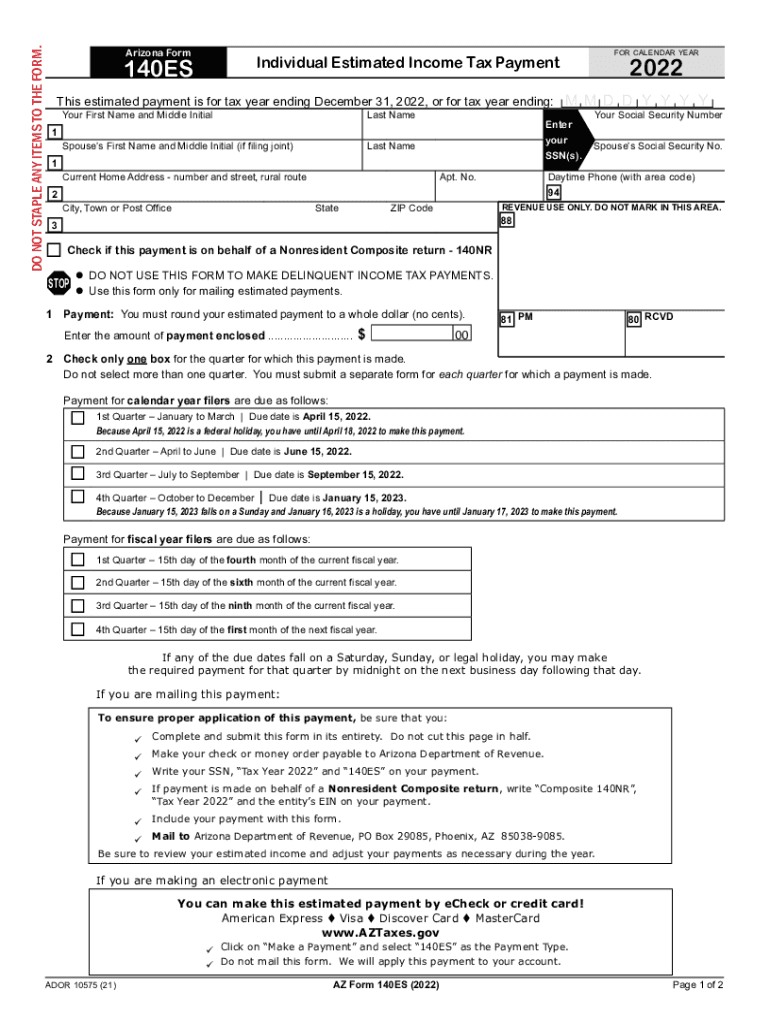

Arizona Estimated Tax Payments 20252025 Form Fill Out and Sign, Instructions for form 2210 (2023) underpayment of estimated tax by individuals, estates, and trusts. The 2023 connecticut income tax.

20252025 Form OK OW8ESSUP Fill Online, Printable, Fillable, Blank, If first payment is [ ] april 15, 2025, enter 1/4 of line 5 [ ] sept. Local or special nonresident income tax:

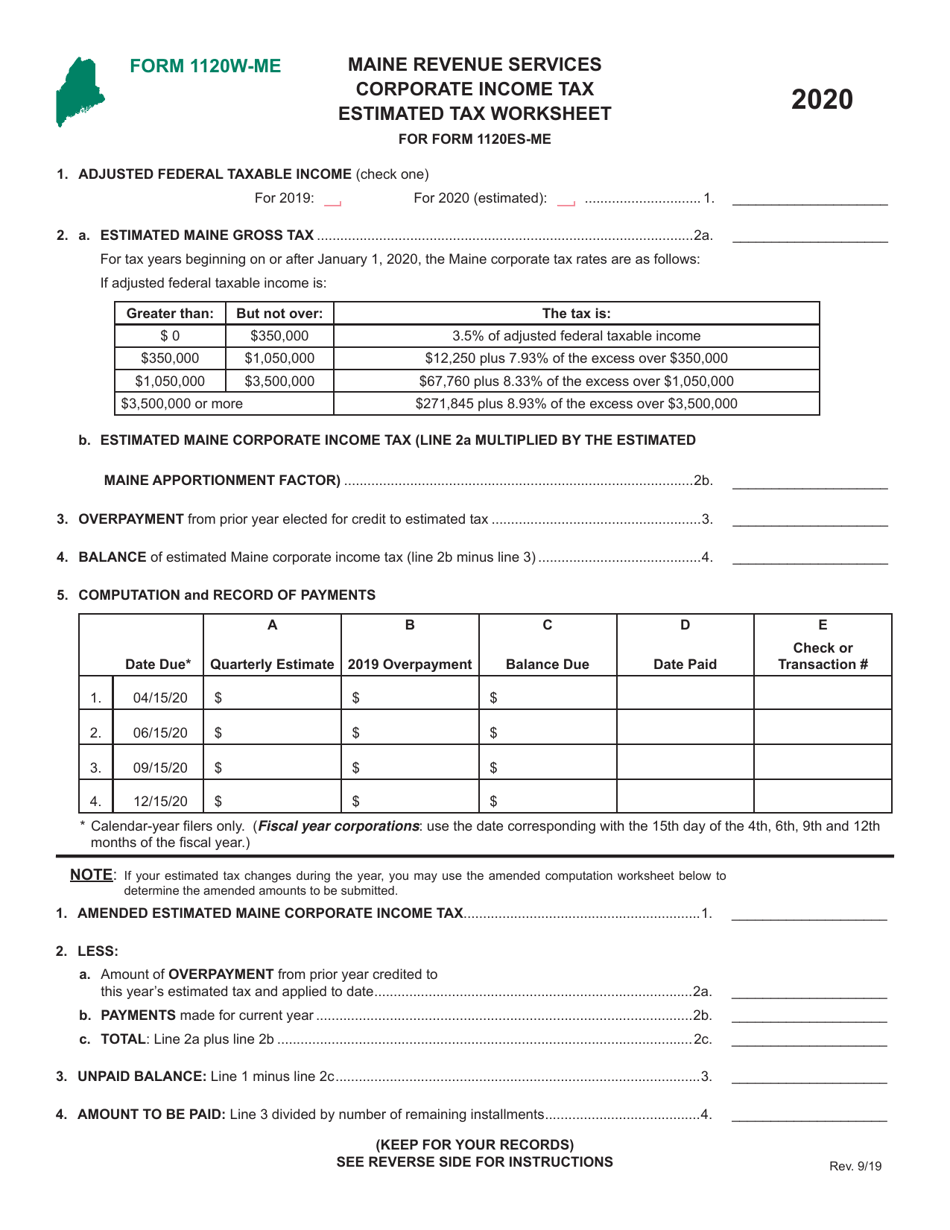

Form 1120WME Download Printable PDF or Fill Online Corporate, Generally, a fiduciary of an estate or trust must pay estimated tax if the estate or trust is expected to owe at least $1,000 in tax for 2025 and can expect its withholding. If you use the worksheets and tables in this publication, follow these steps.